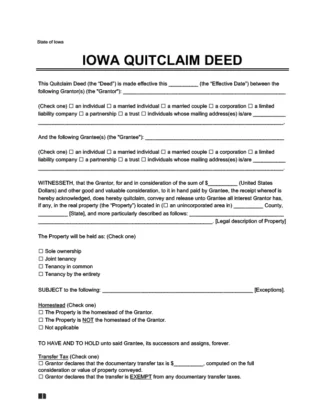

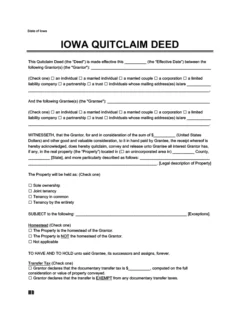

Iowa Quitclaim Deed Form

An Iowa quitclaim deed is a document that legally transfers one person’s or entity’s (grantor) interest in real property to another (grantee).

While a warranty deed guarantees that the grantor owns all rights and titles to real property, free and clear, a quitclaim deed does not. It gives a grantee or buyer whatever ownership rights and title the grantor seller has, which may not be the total or any interest. Real estate buyers should use quitclaim deeds for transactions involving family or other trusted parties.

Laws & Requirements

Signing Requirements: Iowa Code § 558.20: A quitclaim deed must be signed by the grantor before a notary public.

Recording Requirements: Iowa Code § 558.13: To be valid against third parties, the Iowa quitclaim deed must be recorded at the Office of the County Recorder where the real estate is.

Transfer Tax: Yes. The county assesses a transfer tax calculated on the total sale price over $500.00. For each increment of $500.00, the tax is $.080 after the first $500. The document should state the exemption if no taxes are due because the transfer is exempt under Iowa Code § 428A.

Additional Documents: All documents that convey real estate, including the quitclaim deed, must be accompanied by a Declaration of Value, tax form 57-006 (form instructions), unless exempt, and a Groundwater Hazard Statement (and Attachment #1, when necessary) when filing with the County Recorder.

Download: PDF or MS Word.

- How to File

- Costs and Fees

How to File

- Locate Legal Description: Find the property’s legal description on the existing deed; contact your county recorder if necessary.

- Fill Out Form: Complete the quitclaim deed form, ensuring it includes all required information and follows formatting guidelines.

- Transfer Legal Description: Use the original deed to accurately transfer the property’s legal description onto the quitclaim deed.

- Complete Required Forms: If applicable, fill out the value declaration and groundwater hazard forms.

- Notarize: Have the grantor sign the quitclaim deed before a notary public and obtain additional signatures.

- File Deed: Submit the completed quitclaim deed to the County Recorder’s Office where the property is located.

Costs and Fees

Recording Fees:

- Generally, it is $5 per page or transaction, with an additional $1 per transaction, but it may vary by county, so checking with the local county recorder’s office is recommended.

Taxes:

- Transfer Tax: Imposed on certain real estate transactions, paid by the grantee, with exemptions including wills, leases, and family transfers, among others; the rate is $0.80 for every $500 of the sale price after the first $500.

- US Gift Tax: None at the state level in Iowa; federal tax applies if gifts exceed IRS exemptions, necessitating Form 709 in tax filings.

- Capital Gains Tax: State tax repealed for non-farming real estate after January 1, 202; federal tax depends on consideration, income, and ownership duration; consult a tax professional.

Create Your Iowa Quitclaim Deed in Minutes!